form 990 schedule r instructions

Overview of Form 990 Schedule R

Form 990 Schedule R is a supplementary document attached to Form 990‚ providing detailed information on related organizations and transactions with them. It ensures IRS compliance and public accountability by disclosing financial interactions and governance structures between the filing organization and its related entities‚ including disregarded entities‚ tax-exempt organizations‚ and partnerships. This schedule is essential for transparency and proper reporting of relationships that may impact tax-exempt status.

Purpose of Schedule R

The purpose of Schedule R is to provide detailed information about related organizations and transactions with them. It ensures compliance with IRS requirements by disclosing financial interactions‚ governance structures‚ and relationships that may impact tax-exempt status. This schedule enhances transparency and accountability‚ allowing the IRS and the public to understand the filing organization’s connections and dealings with related entities‚ including disregarded entities‚ partnerships‚ and other tax-exempt organizations.

Key Elements Reported in Schedule R

Schedule R requires detailed reporting on related organizations‚ including their names‚ addresses‚ and employer identification numbers. It also discloses transactions such as loans‚ grants‚ and leases between the filing organization and its related entities. Additionally‚ it captures information on partnerships‚ disregarded entities‚ and other relationships impacting tax-exempt status. The schedule ensures transparency by documenting financial interactions and governance structures‚ providing a comprehensive overview of the organization’s relationships.

Who Must File Schedule R?

Organizations must file Schedule R if they answered “Yes” to lines 33‚ 34‚ 35b‚ 36‚ or 37 in Part IV of Form 990.

Eligibility Criteria for Filing Schedule R

An organization must file Schedule R if it answered “Yes” to questions 33‚ 34‚ 35b‚ 36‚ or 37 in Part IV of Form 990. This includes entities with related organizations‚ disregarded entities‚ or certain transactions. The schedule is required to ensure compliance with IRS regulations and to provide transparency into financial dealings with related parties‚ such as partnerships‚ corporations‚ or trusts. Accurate reporting is essential for maintaining tax-exempt status and public accountability.

Organizations Exempt from Filing Schedule R

Certain organizations are exempt from filing Schedule R‚ including those with limited assets or receipts. Specifically‚ organizations eligible to file Form 990-EZ and small filers with gross receipts under $200‚000 and assets under $500‚000 may be exempt. However‚ exemptions apply only if they have no related organizations or transactions requiring disclosure. The IRS guidelines outline these exceptions to simplify reporting for smaller entities while ensuring compliance for larger organizations with more complex relationships.

Structure of Schedule R

Schedule R is organized into four parts‚ each addressing specific types of related organizations and transactions. Parts I-IV detail disregarded entities‚ tax-exempt organizations‚ partnerships‚ and corporations or trusts‚ ensuring comprehensive reporting of relationships and financial interactions for transparency and compliance.

Parts I-IV of Schedule R

Part I reports disregarded entities‚ requiring their name‚ EIN‚ and primary activity. Part II details related tax-exempt organizations‚ while Part III focuses on partnerships. Part IV covers corporations or trusts‚ ensuring comprehensive disclosure of financial interactions and governance structures. Each part requires specific information to ensure transparency and compliance with IRS regulations‚ aiding in the accurate reporting of relationships and transactions between the filing organization and its related entities.

Additional Sections and Schedules

Additional sections and schedules in Form 990 Schedule R provide supplementary information to Parts I-IV. These include attachments like statements‚ supporting documents‚ and disclosures. They offer detailed explanations for specific transactions or relationships‚ ensuring clarity and compliance. Organizations must ensure all sections are completed accurately‚ as they are crucial for a comprehensive understanding of the filing organization’s interactions with related entities and partnerships‚ aligning with IRS requirements for transparency and accountability.

Instructions for Completing Schedule R

The IRS provides detailed instructions for completing Schedule R‚ ensuring accurate reporting of related organizations and transactions. These instructions are continuously updated for clarity and compliance.

General Filing Instructions

Organizations required to file Schedule R must complete all applicable parts (I-IV) based on their relationships and transactions. Ensure accuracy in reporting related entities‚ transactions‚ and governance. Follow IRS guidelines for proper disclosure‚ and submit the schedule with Form 990. Late or incomplete filings may result in penalties. Refer to the IRS instructions for specific details and updates‚ ensuring compliance with all regulatory requirements for transparency and accountability.

Specific Instructions for Each Part

Each part of Schedule R requires detailed reporting: Part I for disregarded entities‚ Part II for related tax-exempt organizations‚ Part III for partnerships‚ and Part IV for corporations or trusts. Provide names‚ EINs‚ primary activities‚ and legal domicile for each entity. Report transactions‚ governance‚ and financial relationships accurately. Ensure compliance with IRS definitions and examples provided in the instructions for proper classification and disclosure of each relationship and transaction.

Transactions with Related Organizations

Schedule R requires reporting financial transactions with related organizations‚ including loans‚ grants‚ leases‚ and sales. Detailed disclosure ensures transparency and compliance with IRS regulations.

Types of Transactions Reported

Schedule R requires detailed reporting of various financial transactions between the filing organization and its related entities. These include loans‚ grants‚ leases‚ sales‚ and service agreements. Organizations must disclose the nature and amount of these transactions‚ ensuring transparency and compliance with IRS regulations. Proper documentation is essential to avoid discrepancies and demonstrate adherence to tax-exempt standards.

Documentation Requirements

Proper documentation is essential when completing Schedule R. Organizations must maintain detailed records of financial transactions‚ including contracts‚ agreements‚ and ledgers. Accurate identification of related entities‚ such as their EINs and legal structures‚ is required. Additionally‚ documentation must support the nature and amount of transactions‚ ensuring compliance with IRS regulations. Clear and complete records help avoid penalties and demonstrate adherence to tax-exempt standards.

Purpose and Importance of Schedule R

Schedule R ensures compliance with IRS requirements and enhances public transparency by disclosing relationships and transactions between the filing organization and related entities‚ promoting accountability and trust.

IRS Requirements and Compliance

The IRS mandates filing Schedule R to ensure transparency and compliance‚ particularly for organizations reporting related entities or transactions. Filing is required if the organization answered “Yes” to specific questions in Form 990‚ Part IV. Schedule R must be completed accurately‚ with detailed information on related organizations‚ financial transactions‚ and governance structures. Failure to comply may result in penalties or loss of tax-exempt status‚ emphasizing the importance of precise reporting and adherence to IRS guidelines.

Public Transparency and Accountability

Schedule R enhances public transparency by requiring detailed disclosures about related organizations and transactions‚ ensuring stakeholders can assess the organization’s operations. This accountability promotes ethical practices and legal compliance‚ fostering trust in the organization’s activities. By making this information publicly available‚ the IRS ensures that exempt organizations maintain high standards of openness and integrity in their financial dealings and governance structures.

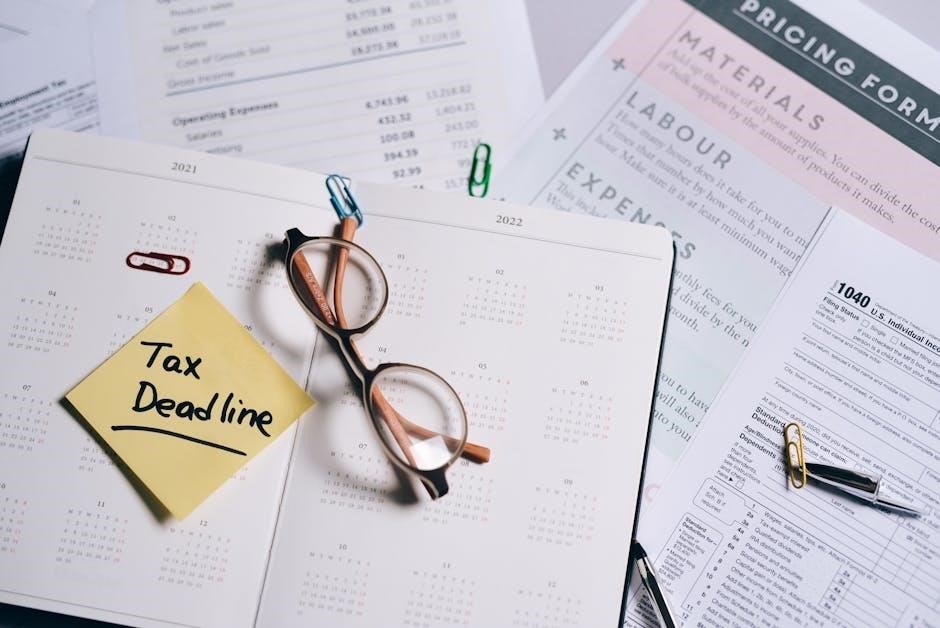

Filing Requirements and Deadlines

Schedule R must be filed annually with Form 990 by the organization’s tax year deadline. The IRS uses continuous-use forms‚ effective for tax year 2024 and beyond‚ ensuring timely compliance and accurate reporting of related transactions and partnerships.

When to File Schedule R

Schedule R must be filed with Form 990 by the organization’s tax year deadline. It is required if the organization answered “Yes” to lines 33‚ 34‚ 35b‚ 36‚ or 37 in Part IV of Form 990. The IRS uses continuous-use forms‚ effective for tax year 2024 and subsequent years. Schedule R ensures compliance by reporting related organizations and transactions‚ with specific instructions guiding the filing process for accurate and timely submission.

Consequences of Late or Incomplete Filing

Failing to file Schedule R on time or submitting an incomplete form can result in penalties‚ including a $20 daily fine‚ up to $10‚000 annually. Severe cases may lead to loss of tax-exempt status. Incomplete filings can trigger IRS audits‚ delaying processing and causing operational disruptions. Organizations must ensure accurate and timely submissions to maintain compliance and avoid reputational damage. The IRS emphasizes strict adherence to deadlines and reporting requirements.

Common Mistakes to Avoid

Common errors include inaccurate reporting of related organizations and failure to properly document transactions. Ensure all details are precise to avoid compliance issues and delays.

Errors in Reporting Related Organizations

Common mistakes include omitting related organizations‚ providing incorrect EINs‚ or misclassifying relationships. Ensure all entities are accurately reported‚ including disregarded entities and partnerships. Verify names‚ addresses‚ and primary activities to avoid errors. Misreporting transactions or failing to disclose governance structures can lead to compliance issues. Carefully review Part I-IV of Schedule R to ensure completeness and accuracy in reporting related organizations and their interactions with the filing organization.

Incorrect Documentation of Transactions

Common errors include failing to report all financial transactions with related organizations or providing incomplete details. Ensure accurate documentation of loans‚ grants‚ and leases‚ including terms and amounts. Misreporting values or omitting required disclosures can lead to compliance issues. Verify all transaction details and consult IRS guidelines to ensure proper reporting and avoid penalties or delayed processing of Form 990.

Resources and Support

Access IRS guidance‚ publications‚ and tools like Tax990 for assistance. Professional help is also available for accurate filing and compliance with Schedule R requirements.

IRS Guidance and Publications

The IRS provides comprehensive guidance and publications for Schedule R on their official website. Visit IRS.gov for access to updated forms‚ instructions‚ and resources. Continuous-use forms and instructions ensure compliance with the latest regulatory changes. The IRS also offers detailed explanations in the Instructions for Schedule R and related publications to assist with accurate reporting of related organizations and transactions. Utilize these resources to ensure proper filing and adherence to IRS requirements.

Professional Assistance and Tools

For accurate filing‚ consider using IRS-authorized e-file providers like Tax990‚ which automates Schedule R based on your Form 990 data. Tax software often includes guides and templates to simplify reporting. Additionally‚ consulting with legal or accounting professionals specializing in nonprofit tax law ensures compliance and accuracy. These experts can navigate complex filings and interpret IRS guidelines effectively‚ streamlining the process and minimizing errors.