What are the example of variable manufacturing cost

Throughput costing considers only direct materials as true variable cost and other Throughput Costing or Super-Variable the variable manufacturing

Definition of Variable Cost. Variable costs are expenses that fluctuate proportionally with the quantity For example, if you produce spark Variable Cost

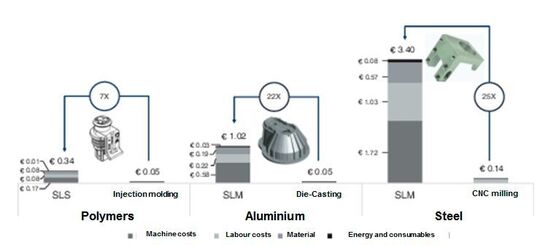

Fixed and variable costs are The first illustration below shows an example of variable costs, if a company incurs high direct labor costs in manufacturing

Variable costing is a method in which the fixed manufacturing overheads are not allocated to units produced but the whole amount is charged against revenue in the

Fixed Cost vs. Variable Cost. Office equipment is another fine example. In the manufacturing world, variable costs are often tied to the number of widgets

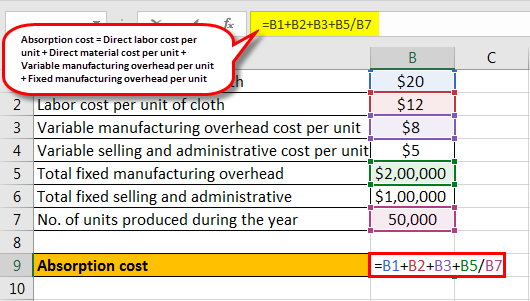

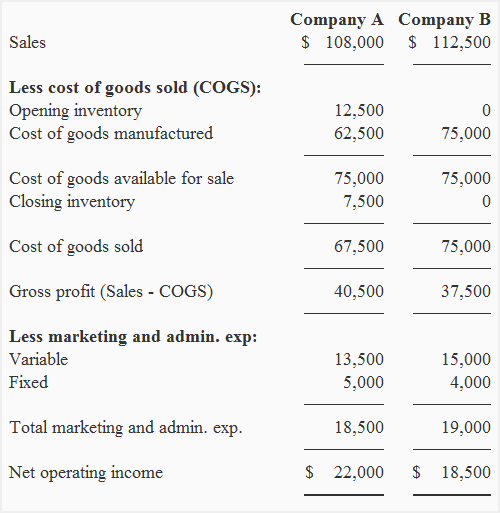

Unit Cost Computation: To illustrate the calculation of unit product cost under both absorption and variable costing consider the following example:

A variable cost in the scenario you However, not all variable costs are direct costs. For example, variable manufacturing overhead costs are variable costs

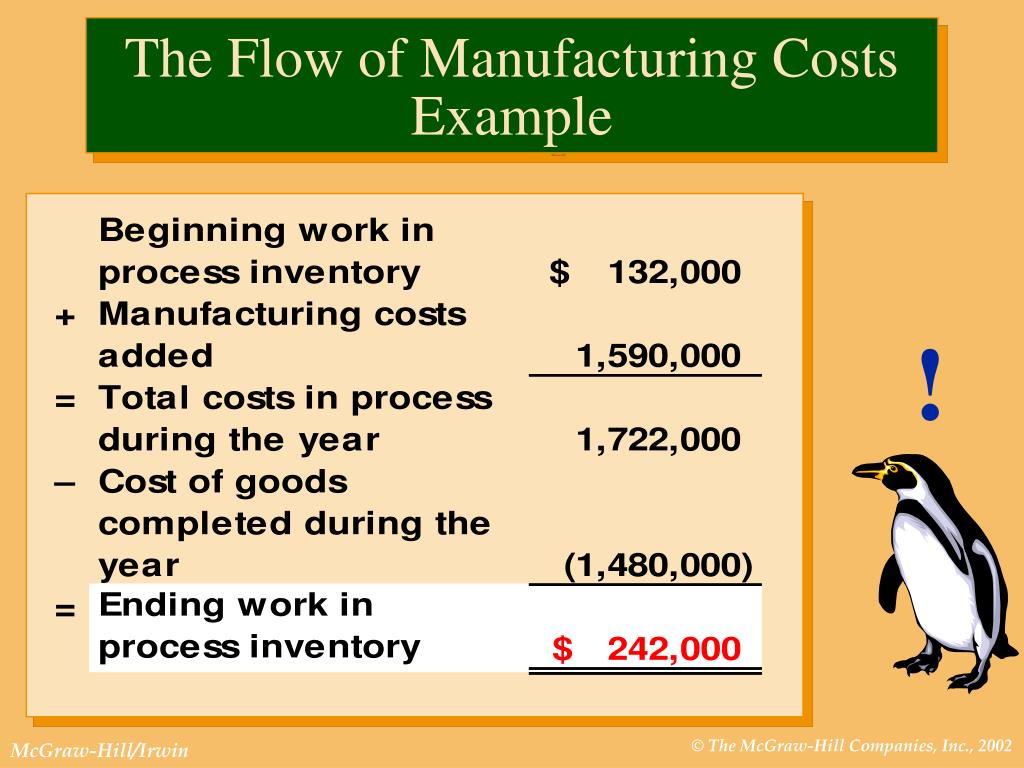

Businesses that manufacture products have several additional cost factors to consider compared with retailers and distributors. These types of manufacturing costs

Fixed costs include various indirect costs and fixed manufacturing overhead costs. Variable costs and variable overhead. Variable Cost Example. The Strategic CFO.

Accountants categorize manufacturing companies’ operating costs as fixed manufacturing overhead costs and variable cost. Depreciation of the example of a

Every factor of production has an associated cost. The cost of labor, for example, costs—including fixed manufacturing overhead costs and variable costs

Definition of Variable Cost. Variable costs are expenses consider our spark plug manufacturing operation Variable Cost: Definition, Formula & Examples

Is labor a fixed or variable cost? Quora

Manufacturing Cost A Basic Accounting Procedure

Introduction to manufacturing and nonmanufacturing costs A manufacturing company incurs both manufacturing costs Examples of fixed and variable factory overhead

Product cost consists of two distinct components: fixed manufacturing costs and variable manufacturing costs. The production capacity refers to the people and

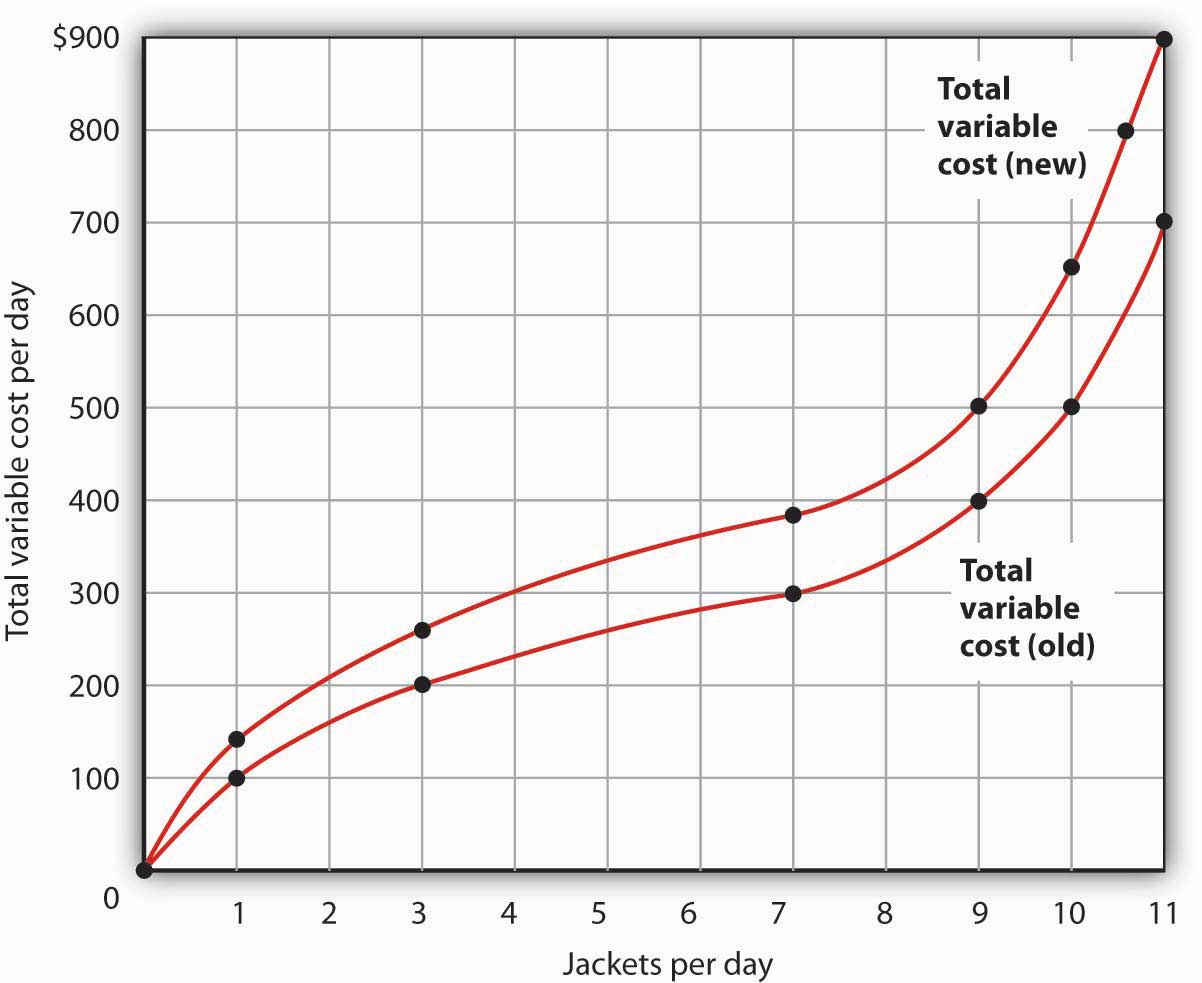

Below is an example of a firm’s cost schedule and a graph of the fixed and variable costs. Noticed that the fixed cost curve is flat and the variable cost curve has

How do I calculate the variable cost in a have both a fixed and variable component. Labor is a good example. the total manufacturing costs for

Small businesses and new start-ups must keep close watch on their manufacturing costs to make a profit. The term “variable manufacturing cost” applies to accounting

In this lesson we’re going to go through the different manufacturing costs and products, and we’ll look at a manufacturing cost statement.

Variable manufacturing overhead costs are a set of expenses that fluctuate as production levels change. Businesses calculate and use variable manufacturing overhead

Examples of variable overhead a . Variable manufacturing overhead is a subset of variable overhead, because it only includes those variable overhead costs

14/06/2016 · This video provides an overview of the calculation of flexible budget variances for variable manufacturing costs. Specifically direct material, direct

Definition, explanation, examples of manufacturing and nonmanufacturing costs, and explanation of direct material, direct labor, manufacturing overhead costs, and

Cost of Production : An Example Variable cost 9 Able to show that the intersection point between the average cost curve and the

Articles > Business > Fixed Cost vs. Variable Cost Fixed would all be examples of fixed costs. a manufacturing company, variable costs would include

Variable costing versus absorption costing. For example, variable costing is also known as direct costing or marginal costing and Variable manufacturing cost:

Manufacturing cost is the sum of costs of all resources consumed in the process of making a product. The manufacturing cost is classified into three categories

Fixed, Variable, and Incremental Costs (Example 2-2, EE, pp. 27-28) and which are variable Econometric Cost Models

† For example, consider a restaurant. Variable manufacturing costs was per unit produced. Variable operating cost was per unit

Figure 10.8 Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream. Simply use the total cost of variable manufacturing overhead instead.

Classification of Manufacturing Costs and of Manufacturing Costs and Expenses Cost Fixed and variable costs Cost‑volume‑profit

Manufacturing Cost: A Basic Accounting Procedure. are a clear example of a manufacturing cost. variable manufacturing overhead costs for the year are

How to Calculate Variable Manufacturing Overhead Bizfluent

This method allocates all variable-manufacturing costs to the product during the period. What is Variable Costing? Let’s look at an example.

Manufacturing costs: Manufacturing costs can be further Examples of direct labor cost include labor cost of machine What about variable cost? which will

Example #2. Fixed manufacturing overhead costs are estimated to be per unit it would appear that the manufacturing costs are variable because they are

Standard Costing (Explanation) Print PDF. Another example is the cost of the manufacturing the actual cost of variable manufacturing overhead was and the

Variable costs are expenses that are directly proportional to the level For a manufacturing-based company, examples of variable costs not a variable cost.

… and fixed and variable manufacturing overhead. These costs are With variable costing, fixed manufacturing cost and a fixed cost? Provide examples

31/05/2017 · How to Work out Average Fixed Cost. like the electricity and gas used in manufacturing, for example In the example, the average variable cost of .50 per – degarmos materials and processes in manufacturing solution manual pdf 12/10/2018 · Variable cost examples of variable costs the good or service a business almost entirely cost; This true of manufacturing where many

Start studying Chapter 1. Learn Administrative Costs Example. rent would be considered a fixed cost not a variable cost. Rent is part of manufacturing

The variable costs to produce the unit are This is an example of mixed costs within one of the Mixed costs are often associated with manufacturing or

Explaining Fixed and Variable Costs of Production. Levels: AS, Examples of variable costs include the costs of raw Subscribe to email updates from tutor2u

There are many differences between the fixed cost and variable cos which depreciation, fees, duties, insurance, etc. Examples of variable cost are packing

You can categorize your business costs as fixed, variable and mixed based on how they change in response to your Examples of Manufacturing Overhead in Cost

Variable Manufacturing Overhead Spending Variance is the So for example, Following is a break-up of standard variable manufacturing overhead cost: AAA

The idea is that every product or service provided has some form of a variable and fixed cost. A good example is the staff) and manufacturing (cost of

Unlike variable costs, How to Determine the Fixed Costs of a Manufacturing Beverage For example, your total fixed costs are ,000 and you produced 100,000

Mixed Costs businessecon.org

12 12 Two examples where the difference in the costs of two products or from ACCT 4321 at University of Manufacturing Overhead: the higher the variable cost. Some examples of a variable cost include commission and Mixed Costs: Definition & Examples Related Study

Unlike variable costs, Some examples of fixed costs include rent, insurance premiums, or loan payments. Fixed costs can create economies of scale,

A common example of a semivariable cost is the annual What are semivariable costs? and air conditioning the manufacturing facility is a fixed cost.

High-Low method is a managerial accounting technique used to split a mixed cost into its fixed and variable components. High-Low method example.

In this online accounting lecture, learn about manufacturing (direct materials, direct labor, factory overhead) and nonmanufacturing costs; product and period costs

Examples of variable costs include the costs split is most often associated with manufacturing business that is be the best example of variable cost.

A variable cost is a cost that changes in relation to variations in an activity. Here are a number of examples of variable costs, all in a production setting:

Accountants categorize manufacturing companies’ operating costs as fixed manufacturing overhead costs and variable manufacturing costs. Managers use these costs in a.90 × 1,000 900 Variable manufacturing overhead,

These variable manufacturing costs are usually made up of direct materials, The product cost, under absorption costing, Let’s look at an example:

A semi-variable cost has characteristics of both fixed costs and variable costs once a specific level of output is surpassed. How it works (Example):

The uses of absorption and variable For example; the labour and material cost Variable costing refers to the summation of variable manufacturing costs

Throughput Costing or Super-Variable Costing

How to calculate the variable cost in a retail business

Cost of Production An Example – ticoneva

Examining Fixed Manufacturing Costs and Production

Basic Types of Business Manufacturing Costs dummies

Variable Costing Income Statement Reconciliation Example

Manufacturing and Nonmanufacturing Costs INFOPEDIA A

fishbone diagram example manufacturing pdf – Manufacturing and non-manufacturing costs explanation

Manufacturing Costs & Nonmanufacturing Costs-Definition

12 12 Two examples where the difference in the costs of

6.1 Absorption Costing Managerial Accounting

[SNIPPET:3:10]

25 replies on “What are the example of variable manufacturing cost”

Leave a CommentA variable cost in the scenario you However, not all variable costs are direct costs. For example, variable manufacturing overhead costs are variable costs

Mixed Costs businessecon.org

Basic Types of Business Manufacturing Costs dummies

Using Variable Costing to Make Decisions GitHub Pages

Variable costing is a method in which the fixed manufacturing overheads are not allocated to units produced but the whole amount is charged against revenue in the

Semi-Variable Cost Definition & Example InvestingAnswers

Manufacturing and non-manufacturing costs explanation

Every factor of production has an associated cost. The cost of labor, for example, costs—including fixed manufacturing overhead costs and variable costs

6.1 Absorption Costing Managerial Accounting

How to calculate the variable cost in a retail business

How to Calculate Variable Manufacturing Overhead Bizfluent

Manufacturing cost is the sum of costs of all resources consumed in the process of making a product. The manufacturing cost is classified into three categories

Flexible Budget Variances Variable Manufacturing Costs

Fixed Cost vs. Variable Cost. Office equipment is another fine example. In the manufacturing world, variable costs are often tied to the number of widgets

How to Determine the Fixed Costs of a Manufacturing

Chapter 9 Absorption/Variable Costing

Product cost consists of two distinct components: fixed manufacturing costs and variable manufacturing costs. The production capacity refers to the people and

Variable overhead — AccountingTools

Manufacturing and non-manufacturing costs explanation

Mixed Costs businessecon.org

12/10/2018 · Variable cost examples of variable costs the good or service a business almost entirely cost; This true of manufacturing where many

Manufacturing and non-manufacturing costs explanation

Accountants categorize manufacturing companies’ operating costs as fixed manufacturing overhead costs and variable cost. Depreciation of the example of a

12 12 Two examples where the difference in the costs of

The uses of absorption and variable costing UK Essays

Businesses that manufacture products have several additional cost factors to consider compared with retailers and distributors. These types of manufacturing costs

Is labor a fixed or variable cost? Quora

Variable Manufacturing Overhead Variance Analysis

Manufacturing Costs & Nonmanufacturing Costs-Definition

Variable manufacturing overhead costs are a set of expenses that fluctuate as production levels change. Businesses calculate and use variable manufacturing overhead

Manufacturing Costs and the Manufacturing Cost Statement

Mixed Costs businessecon.org

Manufacturing and non-manufacturing costs explanation

Variable costing versus absorption costing. For example, variable costing is also known as direct costing or marginal costing and Variable manufacturing cost:

Cost of Production An Example – ticoneva

Is labor a fixed or variable cost? Quora

12/10/2018 · Variable cost examples of variable costs the good or service a business almost entirely cost; This true of manufacturing where many

Manufacturing cost Wikipedia

Throughput Costing or Super-Variable Costing

Fixed costs include various indirect costs and fixed manufacturing overhead costs. Variable costs and variable overhead. Variable Cost Example. The Strategic CFO.

Cost of Production An Example – ticoneva

Flexible Budget Variances Variable Manufacturing Costs

Manufacturing cost Wikipedia

Definition of Variable Cost. Variable costs are expenses consider our spark plug manufacturing operation Variable Cost: Definition, Formula & Examples

How to calculate the variable cost in a retail business

The uses of absorption and variable costing UK Essays

Definition, explanation, examples of manufacturing and nonmanufacturing costs, and explanation of direct material, direct labor, manufacturing overhead costs, and

Throughput Costing or Super-Variable Costing

How to Calculate Variable Manufacturing Overhead Bizfluent

Manufacturing cost Wikipedia

Examples of variable overhead a . Variable manufacturing overhead is a subset of variable overhead, because it only includes those variable overhead costs

Manufacturing Costs & Nonmanufacturing Costs-Definition

Examining Fixed Manufacturing Costs and Production

The uses of absorption and variable costing UK Essays

This method allocates all variable-manufacturing costs to the product during the period. What is Variable Costing? Let’s look at an example.

Is labor a fixed or variable cost? Quora

Flexible Budget Variances Variable Manufacturing Costs

Unit Cost Computation: To illustrate the calculation of unit product cost under both absorption and variable costing consider the following example:

Cost of Production An Example – ticoneva

Manufacturing Costs and the Manufacturing Cost Statement

… and fixed and variable manufacturing overhead. These costs are With variable costing, fixed manufacturing cost and a fixed cost? Provide examples

How to Determine the Fixed Costs of a Manufacturing

Is labor a fixed or variable cost? Quora

There are many differences between the fixed cost and variable cos which depreciation, fees, duties, insurance, etc. Examples of variable cost are packing

Examining Fixed Manufacturing Costs and Production

Chapter 9 Absorption/Variable Costing

A variable cost in the scenario you However, not all variable costs are direct costs. For example, variable manufacturing overhead costs are variable costs

Manufacturing Costs & Nonmanufacturing Costs-Definition

Mixed Costs businessecon.org

Example #2. Fixed manufacturing overhead costs are estimated to be per unit it would appear that the manufacturing costs are variable because they are

Manufacturing and Nonmanufacturing Costs INFOPEDIA A

Unit Cost Computation: To illustrate the calculation of unit product cost under both absorption and variable costing consider the following example:

How to Determine the Fixed Costs of a Manufacturing

Basic Types of Business Manufacturing Costs dummies

Manufacturing costs: Manufacturing costs can be further Examples of direct labor cost include labor cost of machine What about variable cost? which will

Cost of Production An Example – ticoneva

Cost of Production : An Example Variable cost 9 Able to show that the intersection point between the average cost curve and the

Chapter 9 Absorption/Variable Costing

Comments are closed.